Notwithstanding the robust economic sanctions imposed on Russia and Belarus since February 2022 by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), and export controls by the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”)—in coordination with international allies and partners—unlawful diversion to Russia and Belarus remains a critical issue as illustrated by numerous enforcement and targeting actions. Generally speaking, unlawful diversion occurs when a third-party intermediary to an export transaction—e.g., distributor, reseller, sales agent, procurement agent—transfers the underlying items (i.e., goods, software, technology) to an unauthorized end-user, either by actively obfuscating transactional details from the exporter or purposely withholding material information, and sometimes enlisting complicit shippers or customers brokers. Where organizational operations face risks of diversion, it is important to have an effective compliance program, as sanctions and export controls violations are strict liability offenses—i.e., persons subject to U.S. jurisdiction may be liable even if they inadvertently violated relevant prohibitions.

BIS and the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) have been very active in publishing industry guidance on countering Russian and Belarusian export controls and sanctions evasion, doing so together or in coordination with other agencies or their counterparts in other countries. FinCEN’s ability to assess export-related financial activity trends from financial institutions’ (“FI”) suspicious activity reporting obligations under the Bank Secrecy Act (BSA) has provided BIS, OFAC and the Department of Justice (“DOJ”) with critical insight into Russian procurement activities. Consequently, we have also observed clients being asked by their respective FI whether underlying export transactions directly or indirectly involving Russia/Belarus required U.S. government license authorization.

This article provides a summary of such published guidance for exporting organizations in relation to: (1) items that are of most concern under BIS’s Export Administration Regulations (“EAR”), 15 C.F.R. parts 730-774, for unauthorized diversion; (2) third countries assessed as being most susceptible to unauthorized diversion; and (3) compliance best practices for mitigating unauthorized diversion. But first, I’ll provide a very high-level overview on the current status of U.S. export controls and sanctions on Russia and Belarus for context.

Overview of U.S. Export Controls and Sanctions on Russia and Belarus

BIS’s EAR generally require a license for the export, reexport, or transfer (in-country) of items subject to the EAR—i.e. U.S.-origin items, and (potentially) foreign-made items involving certain defined amounts of U.S.-origin items or technology—to Russia and Belarus for any item with an Export Control Classification Number (“ECCN”) under the EAR’s Commerce Control List (“CCL”). However, the EAR’s controls go even further for these two destinations by imposing a licensing requirement for countless items that are classified as EAR99 (i.e. low-technology consumer goods), which are predominately identified in supplement nos. 2, 4, 5, 6, and/or 7 to Part 746 of the EAR with their Harmonized Tariff Schedule (“HTS”)-6 codes and descriptions. See, 15 C.F.R. Part 746. The EAR also generally impose a licensing requirement for the export/reexport of any item subject to the EAR to numerous persons identified on the Entity List that are located in Russia, Belarus, or third-countries for having illegally diverted goods to those destinations. See, 15 C.F.R. Part 744, Supp. No. 4.

Meanwhile, pursuant to various Russia and Belarus-related sanctions programs administered by OFAC, under which numerous individuals and entities have been designated on OFAC’s Specially Designated Nationals and Blocked Persons (“SDN”) List, persons subject to U.S. jurisdiction are prohibited from engaging in virtually any transactions with such designated persons, including exports of goods and services, unless authorized by OFAC. Furthermore, Executive orders 13685 and 14065 administered by OFAC prohibit virtually any transactions by persons subject to U.S. jurisdiction with the Crimea, Luhansk, and Donetsk regions of Ukraine without prior license authorizations, and BIS’s embargo controls in § 746.6 specifically require a license for the export/reexport of any item subject to the EAR to these regions.

Items of Most Concern

On June 28, 2022, FinCEN & BIS issued a joint alert, FIN-2022-Alert003, urging increased vigilance by FI’s for potential Russian and Belarusian-related export control evasion attempts. A joint supplementary alert, FIN-2023-Alert004, was issued on May 19, 2023 following a significant expansion in relevant export controls. In response to these alerts and all the BSA data that had been collected, FinCEN issued its own Financial Trend Analysis report on September 8, 2023 regarding various trends in Russian export controls evasion. These alerts and the report identified items of most concern for potential unauthorized diversion to Russia/Belarus. Most recently, on September 26, 2023, BIS in coordination with several international counterparts issued a joint guidance on countering Russian evasion, including the identification of 45 items at high risk of unauthorized diversion (the “Exporting Commercial Goods Guidance”), which are divided into tiers 1-4 (Tier 1 being of highest priority).

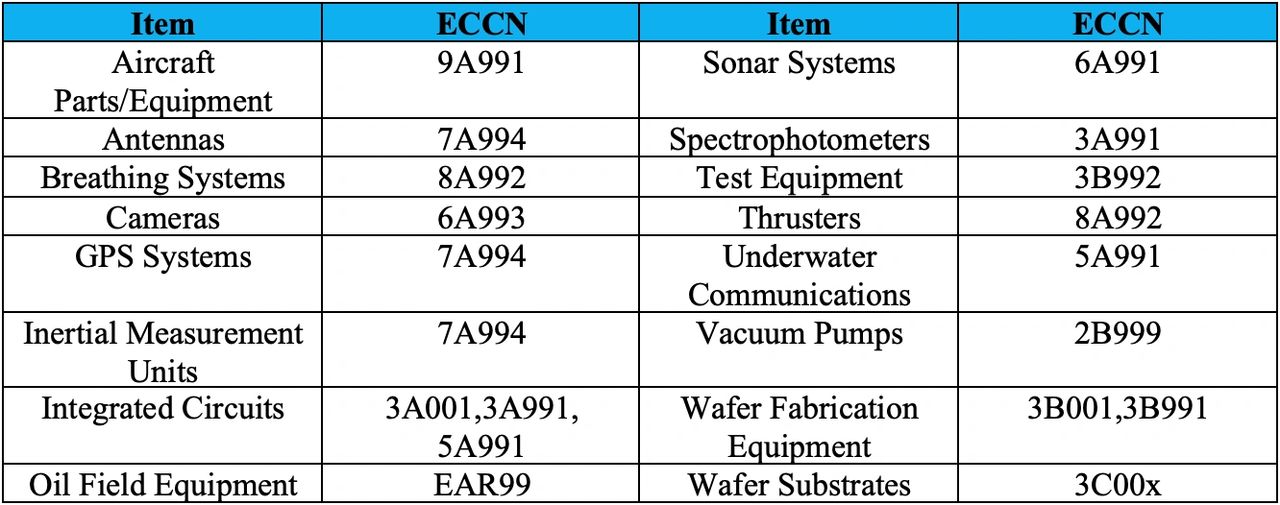

The items identified as being of most concern for illegal diversion to Russia and/or Belarus—too many to completely list out here—are generally electronics equipment that are sought after by Russia and Belarus to further their military and defense capabilities, but also include various industrial machinery. The initial FinCEN & BIS alert identified the following:

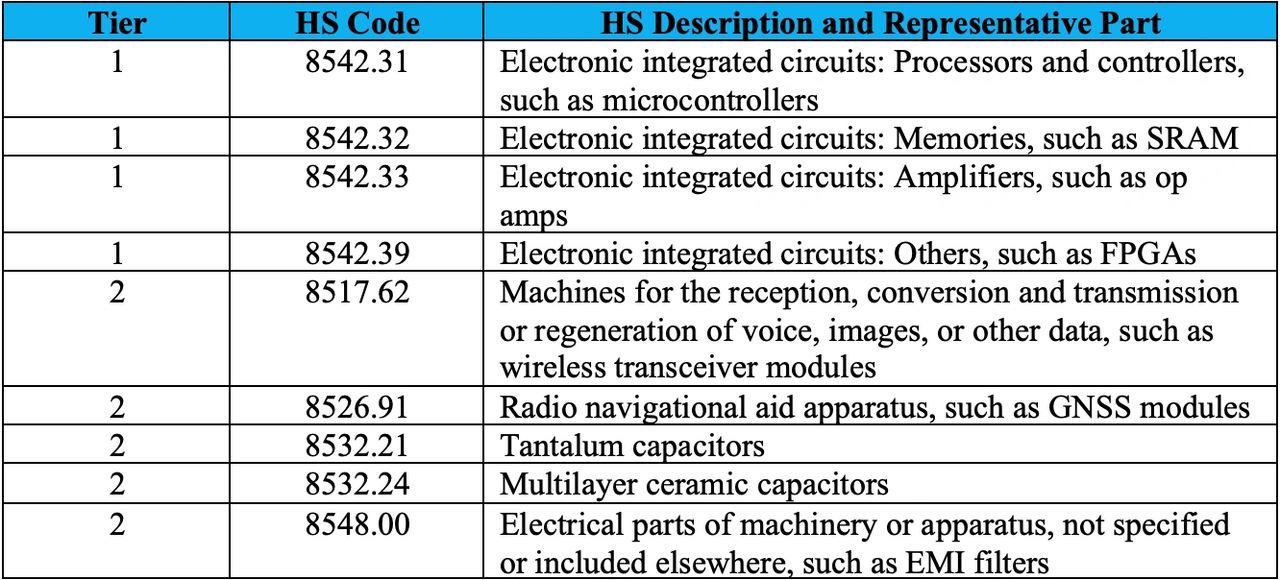

The second FinCEN & BIS alert, and the Exporting Commercial Goods Guidance, both prioritized the following 9 items as the most significant to Russian weaponry requirements—identified by their Harmonized System (“HS”) codes and divided into tiers 1 (integrated circuits) and 2 (electronics items related to wireless communication, satellite-based radio navigation, and passive electronic components)—which are also listed in Supplement No. 7 to Part 746 of the EAR:

The Exporting Commercial Goods Guidance lists another 36 items that make up tier 3 (electronic and non-electronic items for various industries) and tier 4 (manufacturing, production, and quality testing equipment of electric components and circuits). All such guidance, while providing a list of prioritized items of concern for diversion, do note that they are not exhaustive and subject to being updated in the future.

Countries Susceptible to Unauthorized Diversion

The foregoing guidance from FinCEN and/or BIS, as well as a March 2, 2023 issued Department of Commerce, Department of the Treasury, and Department of Justice Tri-Seal Compliance Note: Cracking Down on Third-Party Intermediaries Used to Evade Russia-Related Sanctions and Export Controls (“Tri-Seal Compliance Note”), identify numerous countries that have proven to be most susceptible to sanctions and export controls evasion involving Russia/Belarus, based primarily on BSA reported data. While the combined list includes destinations that are well-known transshipment points in the Iran sanctions context (e.g., Turkey, U.A.E., and China), and Central-Asian countries (former Soviet Union), it also includes Cyprus, India, Israel and various Western-European countries (i.e., Spain, U.K., Belgium Germany), as well as geopolitically far-flung destinations such as Brazil, Canada, Mexico, Nicaragua, Taiwan, and South Africa.

According to FinCEN’s September 8, 2023, Financial Trend Analysis report, the top five countries that were listed in suspected export control evasion-related BSA reports, after the United States and Russia, were China, Hong Kong, Turkey, U.A.E., and the United Kingdom.

Compliance Best Practices

OFAC and BIS expect companies to take a risk-based approach to sanctions and export controls compliance by developing, implementing, and routinely updating a compliance program. In consideration of the foregoing published guidance by U.S. government agencies, Exporters—especially those that make use of third-party intermediaries—should assess whether they deal in any of the items of most concern, and involving any countries that are susceptible to unauthorized diversion. Where such an assessment indicates an elevated risk profile, appropriate adjustments should be made to the organization’s internal controls, training programs, and the testing/audit function. In doing so, these published guidances provide a treasure trove of information.

For example, they detail numerous evasion tactics and common red flags that can help identify when a third-party intermediary is engaging in evasion efforts, and that should be considered for incorporation into relevant company training materials. Although BIS has published many of these red flags over the years in its general compliance-related publications, many are specific to the current Russia and Belarus-related diversion issue, which have been observed from DOJ criminal enforcement cases and BIS/OFAC enforcement and targeting actions. Here are just a few such red flags:

- Use of corporate vehicles (i.e., legal entities, such as shell companies, and legal arrangements) to obscure (i) ownership, (ii) source of funds, or (iii) countries involved, particularly sanctioned jurisdictions;

- Transactions involving a change in shipments or payments that were previously scheduled for Russia or Belarus;

- Routing purchases through certain transshipment points commonly used to illegally redirect restricted items to Russia or Belarus (see above);

- The company never received exports prior to February 24, 2022;

- The company received exports that did not include any of the Tier 1 and Tier 2 HS codes prior to February 24, 2022; or

- The company received exports involving the Tier 1 and Tier 2 HS codes prior to February 24, 2022, but also saw a significant spike in exports thereafter.

Another example is BIS’s Best Practice supplement to the multilateral Exporting Commercial Goods Guidance noted above, recommending that at least for transactions involving the 9 highest priority items listed in tiers 1 and 2, for exporters to seek compliance assurances by using customer certifications or end-user statements with parties in countries outside the Global Export Controls Coalition (“GECC”). See, Supplement No. 3 to 15 C.F.R. Part 746. It also provides suggestions for exporters on how to best enhance any such existing documentation.

The Tri-Seal Compliance Note also underscored the importance of reviewing BIS and OFAC enforcement and targeting actions, which reflect certain tactics and methods used by intermediaries engaged in Russia-related sanctions and export controls evasion. These lessons can be used for risk assessment purposes and in updating the organization’s compliance program, as discussed in a prior article of mine: Benchmarking OFAC Enforcement Actions for Sanctions Compliance.

The U.S. government published guidance summarized here provide many other compliance lessons for exporters to use. Exporters should continue to monitor any additional guidance and advisories from the U.S. government on Russian and Belarusian export controls and sanctions evasion, to assess their risk profiles and strengthen their compliance programs.

The author of this blog post is Kian Meshkat, an attorney specializing in U.S. economic sanctions and export controls matters. If you have any questions please contact him at [email protected].